prince william county real estate tax lookup

Find Prince William County residential property records including owner names property tax assessments payments rates bills sales transfer history deeds mortgages parcel land zoning structural descriptions valuations more. Real estate tax rate.

Gop Prince William Supervisors Criticize Tax Increase Headlines Insidenova Com

370 per 100 in assessed value less 45 of first 20000.

. When prompted enter Jurisdiction Code 1036 for Prince William County. NETR Online Prince William Prince William Public Records Search Prince William Records Prince William Property Tax Virginia Property Search Virginia Assessor From the Marvel Universe to DC Multiverse and Beyond we cover the greatest heroes in Print TV and Film. Enter street name without street direction NSEW or suffix StDrAvetc.

Prince William County officials are pumping the brakes on potential vehicle tax impacts fueled by racing values while reducing increases to real estate taxes. Actual taxes might differ from the figures displayed here due to various abatement and financial assistance programs. Prince William County accepts advance payments from individuals and businesses.

Enter the Tax Account numbers listed on the billing statement. Prince William County Virginia Home. Prince William County VA currently has 447 tax liens available as of April 8.

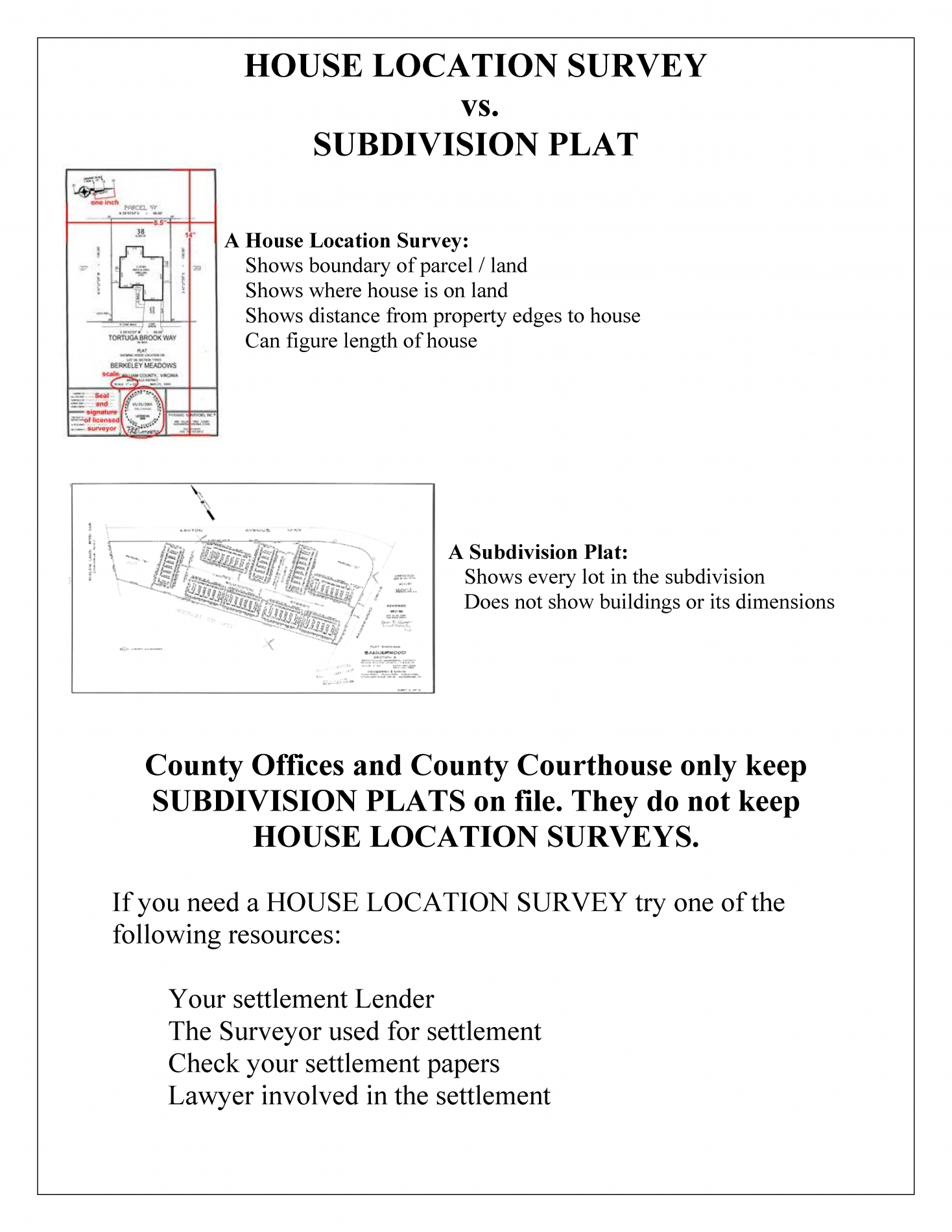

Enter the house or property number. The real estate tax is paid in two. REAL ESTATE Real Estate - per 100 of valuation Base Rate 1115 Fire and Rescue Levies Countywide except for the Town of Quantico 00800 Mosquito and Forest Pest Management previously Gypsy Moth 00025.

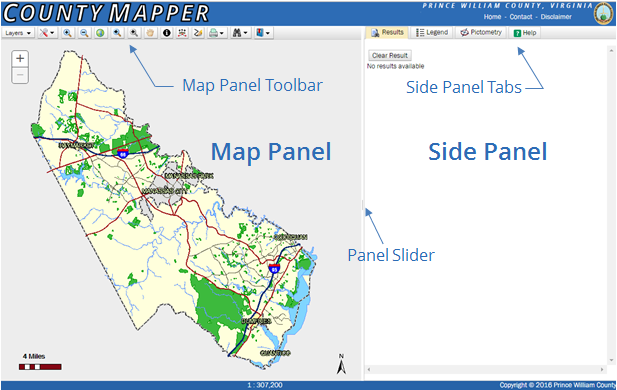

Click here to register for an account or here to login if you already have an account. Prince William County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Prince William County Virginia. Available for parcel features click this button to retrieve tax information about the subject parcel by launching an instance of the Real Estate Assessment web application.

All real property in Prince William County except public service properties operating railroads interstate pipelines and public utilities is assessed annually by the Real Estate Assessments Office. Mmddyyyy mmdd. Advance payments are held as a credit on your real estate personal property or business tax account and applied to a future tax bill when the tax rate and assessment are set or when you file your business tax return.

You will need to create an account or login. Para pagar por telefono por favor llame al 1-800-487-4567. However the measures do not fully.

If you have questions about this site please email the Real Estate Assessments Office. If your account numberRPC has less. The median property tax also known as real estate tax in prince william county is 340200 per year based on a median home value of 37770000 and a median effective property tax rate of 090 of property value.

The median property tax also known as real estate tax in Prince William County is 340200 per year based on a median home value of 37770000 and a median effective property tax rate of 090 of property value. You can pay a bill without logging in using this screen. These buyers bid for an interest rate on the taxes owed and the right.

Than 6 characters add leading zeros to it before searching. Average residential tax bill. The County also levies a supplemental real estate tax on newly.

Press 1 for Personal Property Tax. Press 2 for Real Estate Tax. Real Estate Tax - Prince William County Virginia.

Houses 6 days ago The real estate tax is paid in two annual installments as shown on the tax calendar. Report a New Vehicle. Use both House Number and House Number High fields when searching for range of house numbers.

The AcreValue Prince William County VA plat map sourced from the Prince William County VA tax assessor indicates the property boundaries for each parcel of land with information about the landowner the parcel number and the total acres. Vehicles assessed at 80 value. At Tuesdays Board of.

Proposed county tax rates. Prince William County Property Records are real estate documents that contain information related to real property in Prince William County Virginia. Report a Vehicle SoldMovedDisposed.

If you are searching by sale date please enter it in the following format. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Prince William County officials are pumping the brakes on potential vehicle tax impacts fueled by racing values.

Available for parcel and premise address features click this button to return additional information pertaining to the subject features location. 172 Down from initial 233 Personal property vehicle tax rate. For more information please visit Prince William Countys Department of Real Estate Assessments or look up this propertys current valuation.

By creating an account you will have access to balance and account information notifications etc. Prince William County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. This tax is based on property value and is billed on the first-half and second-half tax bills.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Prince William County VA at tax lien auctions or online distressed asset sales. Included on the real estate tax bills is the special district tax for the gypsy moth abatement program. Free Prince William County Treasurer Tax Collector Office Property Records Search.

Report a Change of Address. If you are searching by gpin please enter it in the following format. These records can include Prince William County property tax assessments and assessment challenges appraisals and income taxes.

Prince William County - Home Page. Report changes for individual accounts. Account numbersRPCs must have 6 characters.

-- Select Tax Type -- Bank Franchise Business License Business. The real estate tax is paid in two annual installments as shown on the tax calendar. This tax is based on property value and is billed on the first-half and second-half tax bills.

Included on the real estate tax bills is the special district tax for the gypsy moth abatement program.

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

New Prince William Deputy County Executive Of Public Safety Announced

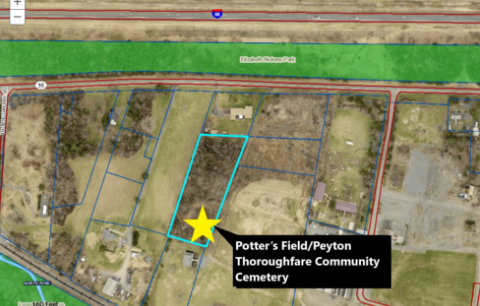

Prince William Board Of County Supervisors Approves Land Purchase In Historic Thoroughfare Community

Where Residents Pay More In Taxes In Northern Va Wtop News

Prince William Co Residents Decry Proposed Hike In Tax Bills Wtop News

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Class Specifications Sorted By Classtitle Ascending Prince William County

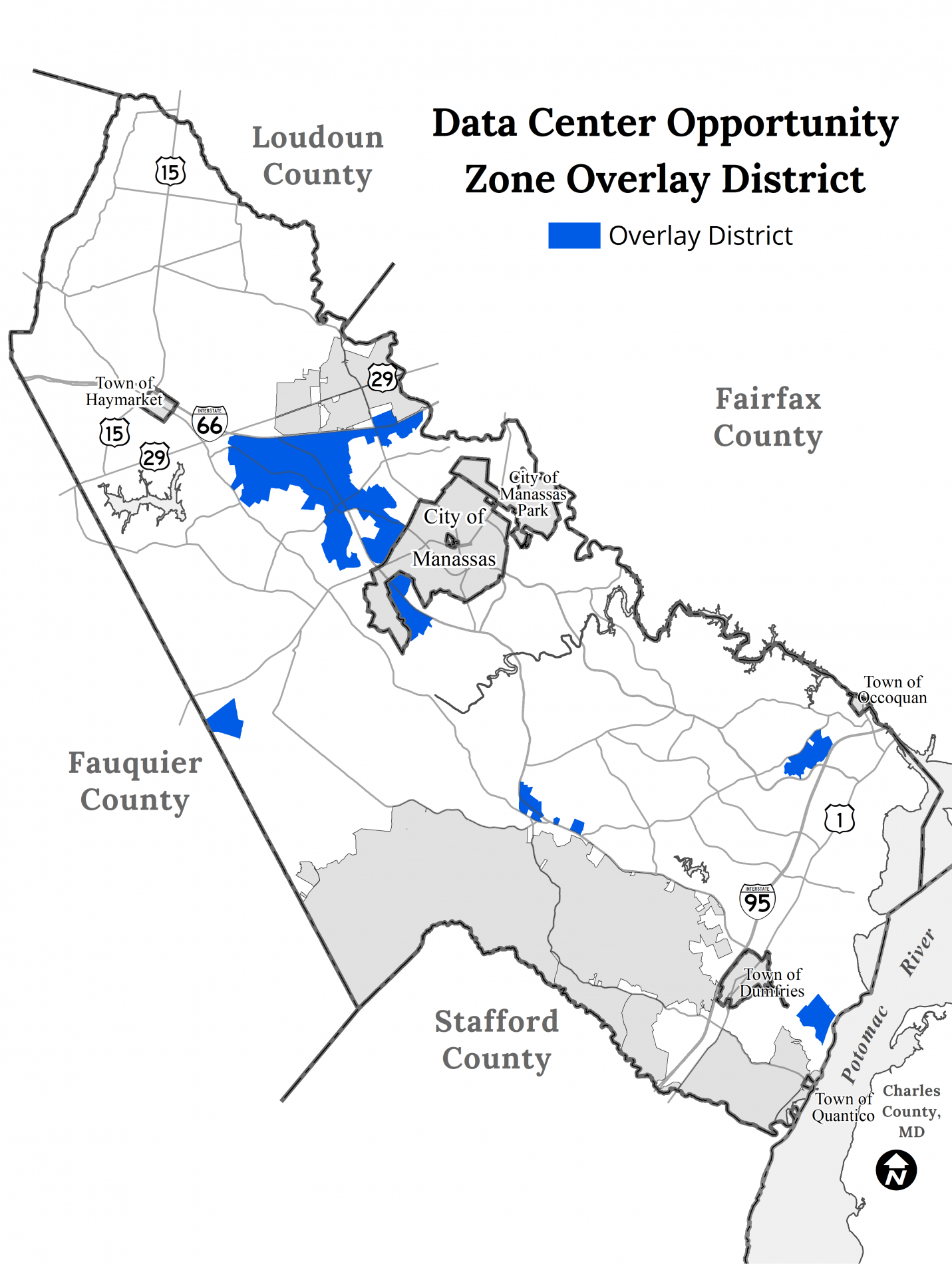

Data Center Opportunity Zone Overlay District Comprehensive Review

Board Commends Prince William Police Department Maj Dawn Harman